No-cost EMI vs Auto-pay: What's better for skilling institutes & EdTech companies?

Explore how our payment solutions can transform your institution’s financial landscape and contribute to long-term success.

Note: This is Part 2 of the No-cost EMI vs Auto-pay blog series.

“We need upfront capital to run our operations. Can we get a No-cost EMI for our institute?”

This is a question we hear frequently from skilling academies and EdTech platforms. The desire for immediate liquidity is understandable—after all, who wouldn’t want all their fees collected upfront? But is no-cost EMI always the best solution even when you need money upfront? Let’s explore why Jodo Flex (our autopay solution) may be the smarter choice.

Understanding the unique cash flow of EdTech & Skilling institutes

Unlike traditional educational institutions that operate on fixed academic calendars, skilling and EdTech institutes typically have a different admission model:

- New batches start frequently (weekly or monthly)

- Course durations typically are shorter than 1 year

- Fee structures often include installment options to boost admissions

Fee structures often include installment options to boost admissions

Let’s walk through a realistic scenario to illustrate the difference:

Imagine you run a UI/UX design academy offering a 6-month course priced at ₹90,000. You provide students with a 6-month installment payment option (₹15,000 per month).

No-cost EMI approach:

With a no-cost EMI solution like Jodo Cred, you’d receive the entire fee amount (minus the subvention charges) upfront when a student enrolls. Sounds perfect, right? But this comes with significant costs:

-

Typically, subvention charges are high – around 18–24% IRR with an upfront fee of 7% for a 6-month EMI plan.

- Loss of admissions occurs when institutions either reject candidates or are forced to offer significant discounts to secure upfront payments.

- Even if the student is willing to pay in say 2 or 3 instalments, the institute ends up paying the subvention for a 6 month EMI plan.

Auto-pay approach:

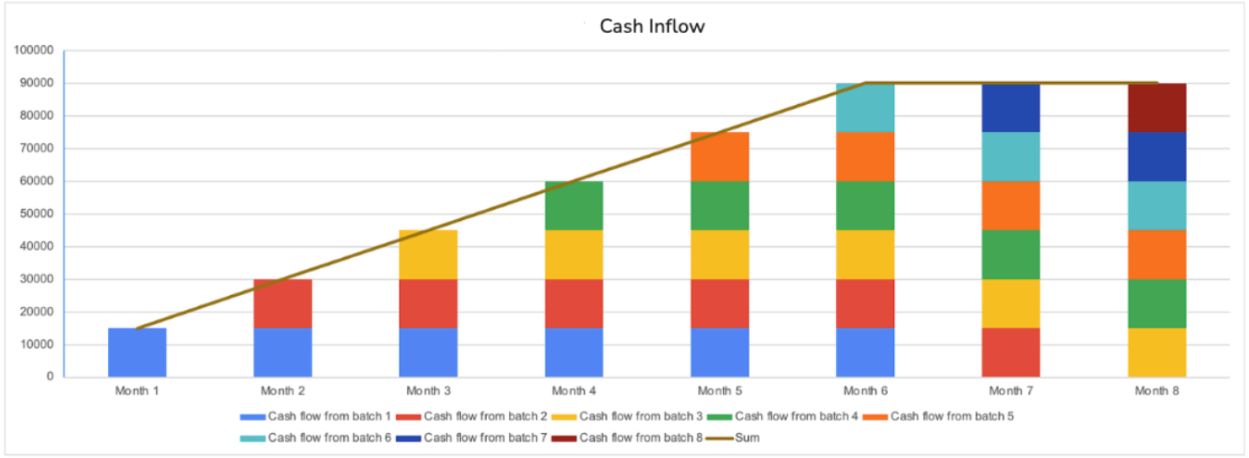

With our autopay solution, Jodo Flex, let’s understand the cashflow scenario:

- Month 1: You collect the first installment (₹15,000)

- Month 2: You collect the second installment, plus first instalments from new students joining

- Month 3 and onwards: The pattern continues, creating an increasingly stable cash flow

This projection illustrates the anticipated monthly collection performance with Jodo Flex

The compounding advantage: Where Jodo Flex truly shines

Beyond the initial 6 months, both no-cost EMI and Jodo Flex ultimately deliver the same total cash flow.

However, the journey with Jodo Flex is far more aligned with your organization and 10 times more cost-effective. With Jodo Flex, the student onboarding is much simpler and provides you with the flexibility to provide a payment schedule as per the needs of the student.

Stronger bottomline:

With minimal transaction charges, more of your fee revenue flows to your bottomlines, making your institution financially stronger.

Aligned organization:

With fees collected through-out the duration of the course, your entire organization - from sales to operations to delivery - stays aligned to deliver a superior experience through the course tenor.

Automated collections & reconciliation:

Jodo Flex eliminates manual follow-ups by automatically handling fee collections and financial reconciliation. This saves your team valuable time and reduces errors.

See how Emversity, a rapidly growing skilling platform, uses Jodo Flex to unlock a whole new stream of students who are unable to secure financing.

Why Jodo Flex is better than Jodo Cred for skilling & EdTech institutes

At Jodo, we’re committed to providing solutions that truly align with our partners’ business models. After analyzing hundreds of skilling institutes and EdTech companies, we’ve concluded that Jodo Flex is simply a better fit for this sector.

For institutes focused on long-term success, the choice becomes clear: a fee collection system that grows with you, mirrors your operational structure, and preserves your margins will always outperform a one-time financing solution.

Jodo Flex isn’t just about collecting fees—it’s about building a sustainable financial foundation that supports your educational mission for years to come.

Want to see how Jodo Flex can transform your institute’s fee collection? Schedule a demo or connect directly with our co-founder Atulya Bhat on LinkedIn.