How Jodo Flex makes school fee payments easier for parents & students

With Jodo Flex, families enjoy seamless automation that eliminates payment stress, improves institutional cash flow, and lets everyone focus on what matters most—quality education.

Picture this: It’s a busy Monday morning, and a reminder pops up about an overdue school fee payment. The school has already sent two notifications, the student feels uncomfortable, and parents scramble to make a last-minute payment with added late fees.

This all-too-familiar scenario is exactly what Jodo’s autopay solution eliminates. But before we delve into how it exactly works, let’s first understand more about Autopay and its rapidly growing adoption.

Understanding Autopay and its rise

Autopay is like having a personal finance assistant. It automatically handles recurring payments—in the case of Jodo Flex, school fees—without any manual effort. Set it up once, and the rest is taken care of seamlessly.

In India’s rapidly evolving digital payment landscape, customers have two primary methods to set up autopay.

NACH (National Automated Clearing House)

What is NACH?

NACH is a centralized electronic payment system developed by the National Payments Corporation of India (NPCI) that has transformed the landscape of repetitive financial transactions. This innovative platform serves as a comprehensive solution for high-volume, periodic interbank transactions, addressing key financial needs across various sectors.

Before NACH, many businesses and banks relied on ECS (Electronic Clearing Service) for recurring payments. While ECS was a step forward, it had limitations like manual paperwork, slower processing, and frequent failures. That’s where eNACH, introduced by NPCI in 2016, revolutionized the process by making everything digital and instant.

Where is NACH used?

Today, NACH powers millions of automatic transactions, including:

✅ Loan EMIs – Never miss a due date again

✅ Utility Bills – Electricity, gas, water, broadband—sorted!

✅ Insurance Premiums – Stay covered without manual reminders

(💡 Fun Fact: Salary deposits use NACH Credit, while all the above payments run on NACH Debit.)

How big is NACH today?

As of January 2025, NACH accounted for 2.5% of all digital payment volumes in India. Notably, its transaction volume outpaced retail methods like debit cards (1.4%) and credit cards (2.2%).

This showcases NACH’s pivotal role in India’s digital payment ecosystem, surpassing traditional payment methods like debit and credit cards in transaction volumes. With the rise of automated payments, NACH has become India’s most trusted, large-scale transaction backbone, ensuring businesses, banks, and consumers enjoy a seamless, reliable experience.

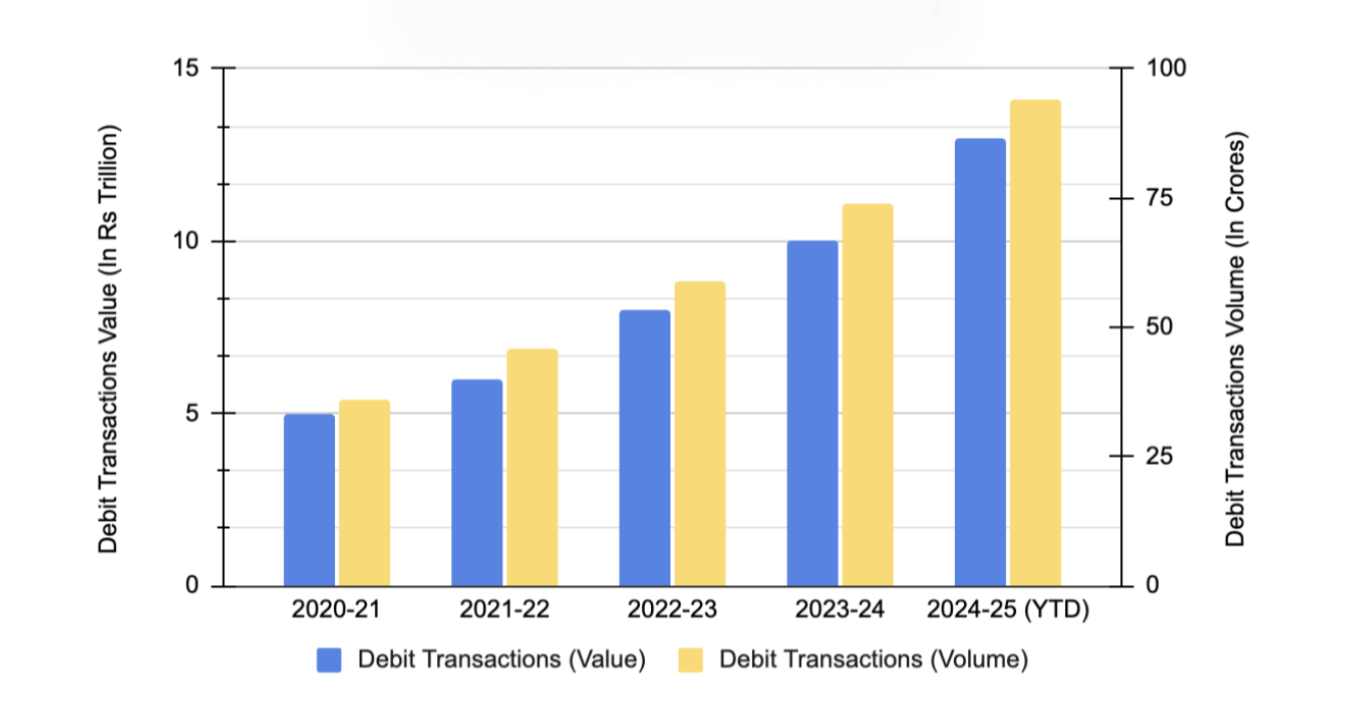

NACH transactions have grown by almost 2.6 times in both value and volume over the last 5 years.

UPI AutoPay

We all know the story of UPI’s meteoric rise. It’s become a global talking point, revolutionizing how India transacts. Now, get ready for the next chapter: UPI 2.0, or UPI AutoPay, to bring the same seamless experience we’ve come to expect from everyday UPI transactions to the world of recurring payments.

Think about it – almost all of us would have experienced the ease of UPI AutoPay when subscribing to services like Jio, Hotstar, Netflix, Kuku FM, and countless others. It’s the magic behind those effortless, automatic deductions that keep our favorite subscriptions running smoothly.

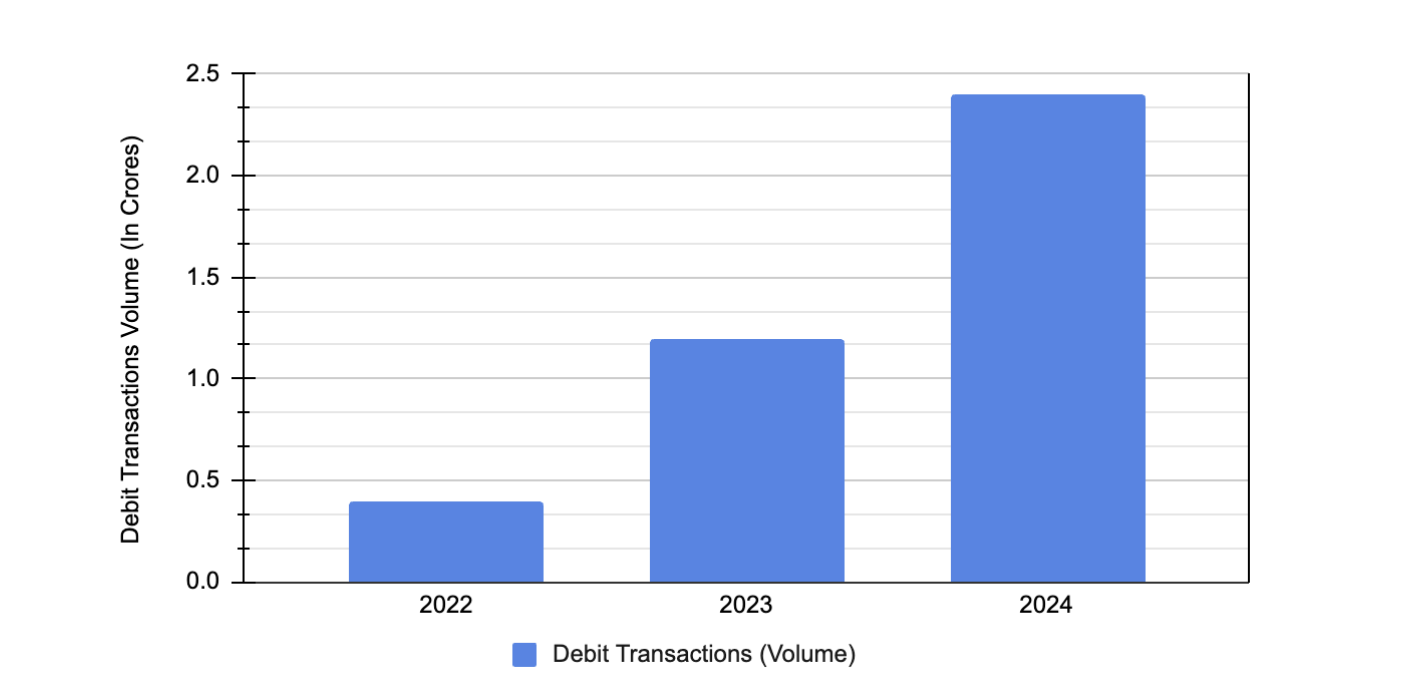

The adoption of this convenient feature is clearly on an upward trajectory, as illustrated by the increasing volume of UPI AutoPay transactions.

At Jodo, we’ve taken the power of autopay and built a comprehensive platform specifically designed for the education fee payments : Jodo Flex.

Jodo Flex: The ultimate Autopay solution

By leveraging NACH and UPI AutoPay technologies, Flex simplifies fee collection for both parents and students by automating the entire fee payment / collection process. With Jodo Flex you get:

1. Secure online payment

Built on the robust NPCI payment infrastructure, Jodo Flex automatically benefits from the same stringent security and risk protection measures that NPCI applies to all digital payments across India. This ensures your transactions are secure and protected.

2. Freedom from financial tracking

Managing school fees is like a significant financial commitment that can span over 12 years of schooling. Think about it – with quarterly fees, transport charges, trip expenses, and more, you could be making payments anywhere between 4 to 15 times a year! Keeping track of this recurring cycle amidst our busy lives can be a real pain point.

With Jodo Flex, say goodbye to the chaos. You gain full visibility of all the payments for the entire year right from the start. No more scrambling to remember different due dates, no more accidentally falling behind on payments, and definitely no more those uncomfortable calls about outstanding fees. Jodo Flex helps you stay completely organized.

3. Flexibility that works with real life

The name “Flex” isn’t just marketing – it embodies a practical feature that understands and adapts to real-life financial situations. Flex combines seemingly opposite yet essential qualities: discipline and flexibility.

Here’s how it works for you:

- Need a little breathing room? Parents can quickly adjust payment dates when cash flow is temporarily tight, maintaining payment discipline without causing undue stress.

- Prefer a different approach this month? Alternative payment methods can be used conveniently before the scheduled due date.

- Facing a temporary dip in your primary account? Account switching options provide a seamless backup, ensuring payments go through without a hitch.

This unique level of flexibility ensures that your school payments can adapt when unexpected expenses arise or when salary credits experience delays, all while keeping your financial commitments on track.

4. Supporting the educational ecosystem

Few realize how payment timing affects the entire educational system. When parents pay on time through Jodo Flex:

- Teachers receive timely salaries without delays

- Schools maintain consistent cash flow for quality programs

- Administrative staff focus on education rather than payment collection

These seemingly small actions contribute directly to the quality of education students receive each day.

Check out how fee collection delays are crippling our institutions

The bottom line

For families juggling multiple responsibilities, autopay through Jodo Flex eliminates a recurring headache. Students focus on learning rather than worrying about fee status, and parents gain peace of mind knowing this essential expense is handled automatically, securely, and on their terms.

With Jodo Flex, school fees never slip through the cracks again – and that’s one less thing keeping families up at night.

Note: Jodo Flex is already available in over 2000 institutes, providing this seamless and flexible fee payment option to their parents.

If you are an institute owner or administrator looking to streamline your fee collections, reduce administrative burden, and enhance parent satisfaction, explore the power of Jodo Flex.

Book a free demo call with a fee collection expert now!

For more insight into how Jodo is revolutionizing fee collection, connect with our Co-founder, Atulya Bhat, on LinkedIn.